SearchUser loginSHRINKING CLEVLANDOffice of CitizenRest in Peace,

Who's new

|

THE REAL CLEVELAND - STREET CONVERSATIONS WITH REZASubmitted by Jeff Buster on Fri, 01/04/2008 - 18:16.

Post in progress, need to upload images from one computer and do Word on another. to be finished soon...It's Wednesday Jan 9, and I still haven't been able to edit my final draft of this pc. Patience please, will get final soon...thanks

On Friday, January 4, 2007 Reza and I began our morning at 10:00 am (like Guy Noir) seeking answers to Cleveland’s persistent questions.

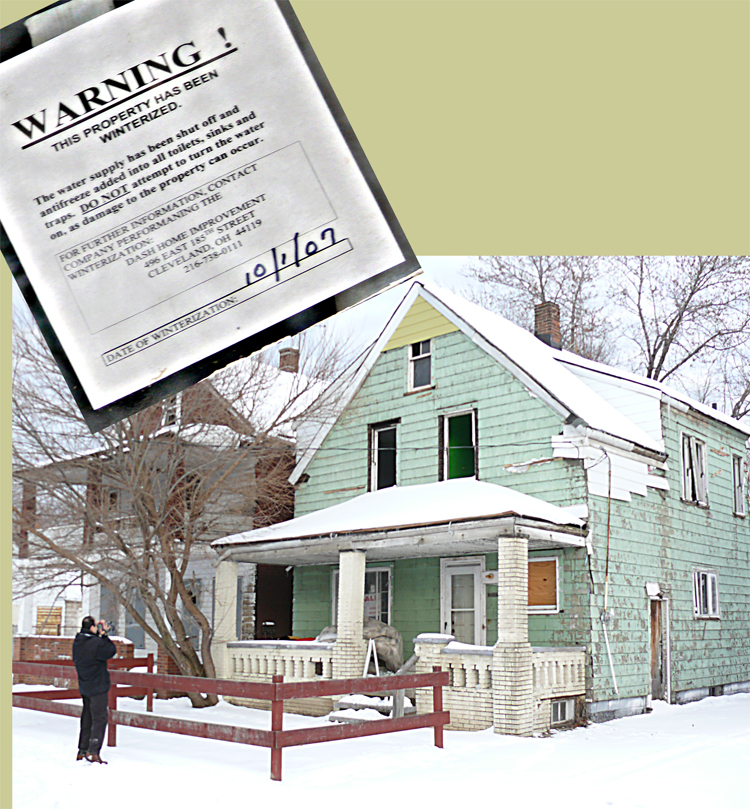

Among Reza’s questions was why so many Clevelanders were losing their homes. I had met Reza a few day’s prior via the blogs of Bill Callahan and Mary Beth Matthews. Reza, who was born in Iran and whose wife is doing post doctorate work at Case, had decided he would produce a video documentary on democracy and the economy in the US, and that he would start that documentary here in Cleveland. In order to get in contact with people in NEO who had experienced foreclosure, Reza told me he Googled “Cleveland foreclosure stories” and hit on Callahan’s blog – a blog which Bill has recently focused on foreclosures. From Callahan’s blog Reza connected to Nemeth’s Brewed Fresh Daily and then to Mary Beth who, aware of my interest in photojournalism in Cleveland – had Reza telephone me for video and story location suggestions. So when Reza and I met up, I suggested visiting the Mount Carmel Road neighborhood (between Martin Luther King and East 110), as it is as good place as any to see many, many homes which have been vacated. With the 3 day old snowfall it was easy to observe which homes and buildings were really empty – they had no foot prints on their doorsteps and no tire tracks in their driveways. There were the homes where the aluminum siding had been stripped off the first floor – up as high as a man could reach. And there were the homes where the aluminum siding had been ripped off all the way up to the roof peak. There was a vacant church and a vacant church nursery school. There were lots of vacant lots where houses had already been demolished and leveled over. Maybe one out of 10 homes was still occupied. Reza wanted to get the story right from someone who lived on the street, so we got out of the car and began shooting from the sidewalk. We couldn’t help but attract attention traipsing through the snow in the 25 degree chill with our cameras pointed at the vacant homes. Actually, sticking out was good because people passing by would ask what we were doing, and that gave Reza the opportunity to begin to ask one neighbor after the other questions. Did the home owner lose his job? Can you get a job around here? Was it drugs? Was it a second mortgage? Where did they move to when they left this house? Out of the state? Some of the people we spoke with were reluctant to have their video taken, but none were reluctant to discuss the issues Reza raised – and as the morning progressed – we got a wide variety of answers to what caused the deterioration in the neighborhoods we visited . However, there was one theme in the discussions that re-occurred a number of times. The re-occurring theme enunciated by those we spoke with was this: If the government wanted to solve the neighborhood problems of crime, drugs, and abandonment, they could do so. – IF THE GOVERNMENT WANTED TO….and the clear converse (that was usually left unsaid) was that the government didn’t want to, that the government had no interest in these neighborhoods, that the neighborhoods were basically ON THEIR OWN. Tawfak Dari was the second person we spoke with, and the first person to make the point that the neighborhood had been abandoned by the government. Mr. Dari has owned and operated the Mount Carmel Deli for the last 14 years - he's standing at the front door in the photo above. His Deli is diagonally across Mount Carmel Road (near E110) from the Cleveland Metropolitan Housing Authority’s Woodhill Homes Estate which was built in 1939. Mr. Dari knows almost all of his customers names, and while Reza and I were speaking with him he would greet his customers and they would say hello to “Tony” – Mr. Dari’s Americanized nickname. When Reza and I had first entered the convenience store – I think Reza and Mr. Dari hit it off because they both had a middle eastern background. We soon learned Mr. Dari had come to the United States from Palestine at age 18 to go to high school in Steubenville, Ohio. Mr. Dari has traveled widely around the US, and over the years has worked construction, a restaurant in Detroit, and his store here in Cleveland. And you don’t operate a convenience store for a decade and a half in Cleveland unless you have keen focus – on safety…on your personal safety.. and your head remains clear. Now right across the street from the Deli was an empty lot, a concrete block garage with a huge hole in one side of it with a tree growing out through the hole, a boarded up house with blue dots on the plywood boarding and “RIP” sprayed across the siding. Next to the deli was a green house with all the front windows smashed out and an old curtain hanging outside the second floor. There was a bunch of trash and a snowy mattress on the front porch. A sign in the window of thegreen house announced “the plumbing had been winterized” Reza observed that the lottery signs and the cigarette signs were fresh and new - while everything else in the neighborhood was old, faded and run down.

(This pc is still in draft - to be continued this week - )

Pickle ingredients led to a knife slashing at a nearby Deli last August.

( categories: )

|

Recent commentsPopular contentToday's:

All time:Last viewed:

Recent blog posts

|

866-740-7575

The same phone number appears on foreclosed properties and demolished lots on the west side of Cleveland. This is criminal. Thank you Jeff for bolding going out and asking questions that need answers. Why instead of centralizing our resources, are we allowing our region to decentralize and disintegrate?

allowing our region to decentralize and disintegrate

All Boarded Up

This look at Cleveland will greet NYTimes readers this Sunday when they stroll out to grab the paper from their driveways and armed with coffee and croissants, they sit back to take in the recap of Cleveland - foreclosureville - the lower ninth ward north.

What's the solution? And why I continue to wonder are there no point of sale inspections? Do we need an opportunity corridor and a westside lake hugging boulevard, a medical mart, to move the port or more simply more inspectors?

Stonecrest Investments

The number connects to Stonecrest Investments. It appears to be this Texas based company. You can find this same sign with the same phone number listing at 3110 Chestnutdale 44109 in my part of town.

The house where the sign can be found was recently demolished by the overnight gang. Unlike, most of the fly-by-night demos in my neighborhood, this one actually needed to come down. Now, the empty lot owned by Deutsche Bank is being marketed for sale, $325 down etc. Which begs the question--who pays off the demo lien?

StoneCrest Investments

I received a phone call yesterday asking for some info regarding some property in

Indiana and we don’t own any residential or commercial property there or in Ohio. When I went online to research the phone number, I found this blog.

The main reason I was joining was to post that my firm - StoneCrest Investments which you have hotlinked in your post - does not own or have any properties listed in

Ohio. The signs shown on the residential properties is not our phone number. Our number toll free number is 800-681-1045 and not 866-740-7575. I’ve called that number myself and received an answering machine that says Stonecrest Investments but we are not affiliated with that company in any way. We deal with commercial real estate developments only in Texas, Mississippi, and

Tennessee.

Sincerely,

Paulette G. Morris

Assistant to the CEO

StoneCrest Investments, LLC

595 Round Rock West Dr., Ste. 701

Round

Rock, Texas

78681

ph: 512-681-1000 x 1012

f: 512-681-1009 cell: 512-632-6363

tollfree: 800-681-1045

www.stonecrestinvestments.com

Thank you for the clarification

I have not been able to track down the actual company using this name. It does not appear to be registered in the State of Ohio

Thanks to StoneCrest for correction

The interaction with Ms. Morris in Texas is an example of how the internet facilitates change and equity - by shinning sunlight on everyone, and on everything, that transpires.

We historically relied on newspapers to provide investigative reporting. That model is obsolete.

Today, everyone, post your thoughts and observations to the internet, let Google algorithms make the connections, and patterns - and the truth - will develop!

This is Democracy…

the other stonecrest investments

Stonecrest Investments, LLC (check out the risks and rewards such as "The building may have been burned down or no longer exist, leaving you with just the land.")

STONECREST INVESTMENTS, LLC, 4300 STEVENS CREEK Blvd, SUITE 275, SAN JOSE, CA 95129

What they own in Cleveland and East Cleveland

Destiny Ventures LLC owns 11026 Mt. Carmel

It appears that the home in the photo is owned by Destiny Ventures 5800 E Skelly Drive Suite 1101 Tulsa, Oklahoma 74135. Their phone number is 918.585.5635. They bought it from Deutsche Bank on June 5, 2007 for $1,000! The home is not listed on their website.

Destiny's website states:

"Destiny Ventures LLC, was formed in April of 1999. We have a combined real estate experience level of 37 years with 32 years experience dedicated to dealing with REO properties. We will acquire and manage properties or loans throughout all 50 states. We are staffed to accommodate single property sales or bulk property sales.

We work effectively with numerous major banks, servicers and outsourcers to help them dispose of problem assets. Whether the assets are aged, have negative equity, title issues, low value or a combination of these problems; we offer a disposal strategy that is both fast and economically feasible for all parties involved."

A quick visit with the address to the Cuyahoga County Auditor’s website (enter the street address) revealed this sale back in June. Back taxes are due as well in the amount of $1,362.07.

It is interesting to see that liens for grass cutting and board up are listed if you hit the “Taxes” tab on the county site.

Why does the telephone answering machine announce "Stonecrest Investments" if the property is owned by Destiny Ventures LLC?

Twice this week

I have approached a truck emptying out foreclosed homes in my neighborhood. One of the trucks represented Maintenance Free Exteriors (any idea where they might be located? It looks like Georgia) and the other represents Safeguard Properties 216-739-2900. The first one seemed reputable with a truck and dumpster clearly marked Jones Roll Off Containers, an Akron company, hired by the aforementioned Maintenance Free Exteriors (Confused yet? I am sure it is intentional).

The other (Safeguard) arrived via an unmarked van and unreputable looking "staff" to "secure" a nearby property (it has taken them two visits and they left one of the structures open to the elements in the interim).

So what's really going on? Will I ever see the real story in my local newspaper? Oh, Plain Dealer, BTW thanks for reporting on the heroin bust in Westlake. Am I surprised? No.

Wake up surbanites, you haven't begun to understand the problem.

lmcshane

Laura, how did you discover that Safeguard was there? Kind of scary. There are so large that they should have marked van.

I asked them

Hard to believe that this happened in Feb 2008...winters are really hard on us...2008 was terrible. Everyone was scrapping. 2009 winter was not as evil.

I will have to say that in 2008, Johanna Hamm, the councilman's assistant was doing superhuman work following up on these suspicous vans and she and Brian found good owners for some of our important architectural homes...and she ran the Summer Fresh Stop program, too.

But now, she is never around and Brian doesn't respond to requests for information and I don't know who to consider the good guy, anymore.

I see a lot in my neighborhood, because I walk to work, walk home, walk to the schools...and I am always scanning. I cherish any sign of improvement. It would be nice to know what's going on...and to not be considered a harpy for caring.

BTW--I mostly gave up on Brian after the HUD housing project...on Denison...up until then he and Johanna seemed to be playing it straight...

it is good that you ask

I think too that it is good to look for signs of improvement. Sometimes it is just a few flowers in a yard that no one cared for but now someone else is living there, or a porch that gets painted.

checking up on destiny

Went to check on Destiny Ventures just for fun.

Apparently they were a no show in housing court in Jan 08. and in September

Cleveland v. Destiny Ventures, L.L.C

They owned a few properties in Cleveland. Thanks Bill Callahan for drawing us a picture.

Does anyone know what the destiny of destiny is today?

.

StoneCrest Investments

I came across this blog quite by accident last week. Don't be fooled that this company is only appearing within Cleveland's city limits. I have been following a piece of property in Cleveland Hts for several months. When a friend told me the property was back on the market, I was surprised. A realtor had recently reported it was off the market. Naturally, I decided to drive by and take a look. Surprise, the sign looks just like the ones in the pictures here except the number is different. The County Auditor's office shows the house was quick claimed by the bank to Stonecrest. However, when you google the phone number, it lists an individual. I tried to follow that name only to find expired listing warnings on Craiglist that led nowhere. I am convinced that housing scams continue despite prosecutions for fraud and other various mortgage crimes. My fear is that communities prefer "house flipping" investors rather than programs to return people to a fair and equitable housing market!Looks to me like the investors just want to make a profit and run!

Blame everyone except the politicians creating the mess....

Its sort of funny, this company, Stonecrest or Invest Wisely or whoever, ends up with worthless houses at the end of the road where -- it is either sell them for peanuts or they get torn down or go to the tax man. The property is worth less than the city taxes each year. You can buy houses all day long in Cleveland for $100 and less, and the City of Cleveland is suing the companies that have to dispose of the garbage? Lol. Almost too funny. The City that has been so mismanaged as to run off half its population in 20 years. The City that has had industry fleeing to the sunbelt for half a century is suing the companies hired to dispose of the real estate made worthless by the very same corrupt and short sighted politicians. The politicians in Washington and City Hall have the power to lower the taxes, eliminate regulation, bring jobs, population and industry back that would make the homes valuable but instead they choose to sue the "garbage men." More great policies from the heart of the midwest. Our Bright future looks dimmer ahead with more of the same idiocy that got us here.

Self-segregation happens.

Self-segregation happens. I check out a real estate website and look at Cleveburg properties. From Manhattan, it is stunning to see the collapse in values in the Old Town The site is zillow.com. I knew those streets. Often, I knew those homes. Many properties look sharp, still. Your dollar gets you a lot of house and yard in Cleveland. You can't make a down payment on a box here in NYC for what you can flat-out buy in the hometown. Yet, even in this bad economy, prices hold up here. What gives?

Well--not demographics. Demographics is destiny. Any sociologist, political scientist or economist knows that. So do smart businessmen. I see that the city still loses residents at an astounding clip. 81,000 residents, out of 477,000, vanished between 2000 and 2010. That's 17%!!!!! On every city block in the town--on average, if there were 100 residents 10 years ago, now there are 83!!!! Who are the vanished? They are the lucky ones, and the most productive ones. Atlas has shrugged.

The taxpayers, the producers, the jobs-makers, the businessmen--big and small, the law-abiding, the studious, the investors, the landlords, the desirable tenants, the young, the educated, the creative, the ones who've worked to develope their God-given gifts, the workers, the savers, the strivers, the persistent, the self-responsible, the sober, the best employees and employers, the risk-takers--gone, vamoosed, out-of-there. It crosses racial and ethnic lines.

It's a social thing. It's self-segregation. It's survival, sometimes. It sounds harsh. It is. But don't blame the people who made a strong quality of life citywide possible. They've just left to take care of themselves. They got tired. They just......................... shrugged.

So, true....Dance to the "CLEVELAND SHRUG!" Exciting dance....

right out of town to green pastures!

We should call it the "CLEVELAND SHRUG" and join the smart ones...and "SHRUG ON DOWN THE YELLOW BRICK ROAD!" Heck, even some of the drunks left town...b/c hundreds of bars are closed down too! (Except those new gentrified places that serve the new generations of Yuppies with glee!)

"In my next thirty years....." as that hillbilly song goes!

Dance, celebrate, and exhale...now that we accept the truth of politics in this great city...

Sure have seen a lot of beautiful places like Munich, Germany and enjoyed driving cross country through Canada with my mom once...we even ate on the boat called Captain John's up there on the lake which she used to work on here in Cleveland...such a treat... The Great Smoky Mountains were also a delight..and the people are so sweet at all those Southern places you stop along the way. It's an amazing world out there beyond the City limits....It's a nice reminder to remember the days we enjoyed such travels...Phoenix and Las Vegas were interesting places to live too. Vermont was a very intriguing place to live. I absolutely loved riding a ferry across the Pacific Ocean, past the Queen Mary, and over to Catalina Island...the water and scuba diving there was absolutely amazing....The suburbs of Kansas City were nice too.

Then, to come back to a place you called home...and watch it deteriorate with a rotten cancer of leadership and to fight for it while watching the malignant elected officials eat away at its core and to feel so powerless...that sucks..... It's like watching a loved one die a slow, painful, and excruciating death....and grieving the duration of their inevitable demise.

There is a bright future along the way... and I have faith in it. It's only been the last couple of years that the realities of such decay has really been revealed at it's truest levels in decades--- publicly. For years the malignancies were hidden behind the cloaks of corruption...and people lived in fear or fell victims to organized crime like is published regularly. While that organized crime will someday be minimized; it will never be gone. There will always be the cultivated crop of people who believe that it's okay to abuse the rest of the world to serve their purpose...We just pray that there will always be folks who care enough to stand up for social justice...

Always Appreciative, "ANGELnWard14"

Go invest wisely

3110 Chestnutdale is now owned by Go Invest Wisely LLC, before that Stonecrest and before that Deutsche Bank. The house on the property was demolished by the City of Cleveland at tax payer expense in 2007. Where is the lien on the property? Why are properties allowed to transfer with demolition liens attached? There are a lot of unanswered questions in Brooklyn Centre, Cleveland Heights and all of northeast Ohio.

just a little more info

Laura-- You've obviously researched this one a bit. I have a few questions for you, as this may work into another project we have going on a short way from Chestnutdale. What did the people buy it for, before DeutscheBank, what did DeutscheBank buy it back for, what did Stonecrest buy it for, and what did Go Invest Wisely buy it for? When was the demolition, and what happened that the property needed to be demolished? Did anybody else from the neighborhood try to buy the property and get the run-around, get rebuffed, or get outbid by the trustee?

There seems to be a pattern in many of these things, a veritable playbook of perfidy.

go invest wisely makes it to pages of PD

Flippers everywhere, meet Cleveland's Tony Brancatelli

Note that Laura McShane first broke this story here and an investor found the story here and perhaps got a few words to the wise.

Just came across this

Just came across this website and posting about Go Invest Wisely and associated properties. Very Interesting!!! I met up with GIW through the Freedom Investment Club headquartered in Canada. They are also associated with Mohawk Properties. The FIC attracts small private investors from the US and Canada to invest in various projects, companies, stocks, etc. For example, the FIC had a big investmant going in real estate development in Alberta related to the shale oil discovery.

The last investment the FIC had for us was through the GIW to purchase foreclosed properties in the US Midwest at approx $20,000 per house. Each house is to be put back on the market at $500 down and below rental price, about $300 per month. They told us that we would be helping the original owners to get back into their property at less than what they were paying for mortgage. Apparently, they are going to local banks and helping them clear out their over-supply of foreclosed houses at bargain rates.

GIW conducts inspections and e-mails propective investors pictures of each house. From what they sent us so far, these houses are very run down and stripped and in need of repair. They also told the investors that we could also sell these houses to local fire departments for practical on-sight fire training, in other words, demolition.

GIW has been hard to get ahold of as they claim to have a huge back-log of paper work. They say that it is difficult to get titles and deeds.

Canadian "Investment Club" looks at Cleveland?

Is this the Freedom Investment Club to which you refered in your comment above? Google also has this link to Scam.com

Do you have a list of properties in Ohio/Cleveland that the Freedom Investment Club (fic) is recommending? Love to see it. You can add a URL link in your comments. Do you know the names of any of the principals behind FIC? What are their names?

I have spent a lot of time in Cleveland - in and around the foreclosed properties. I would be very carefull with your money. You could buy a house and find out that the City of Cleveland tears it down before you get a chance to spruce it up.

If you are going to sink $20,000 into Cleveland for a vacant house, please come down here first and I'll buy coffee and take you on a drive around town to give you a better idea of what you might be getting into.

best,

jeff

-

-

questions.

like who are these people who take their money?

in NY they were prosecuted

Interesting article from my opera: The Resourceful Bear Blog

Violent Crime And Looting Strike Subprime Burdened Cleveland

“Speculators are afraid to come to my district because they know someone will come down on them,” said Franczyk, who noted that tough judges and the city’s Anti-Flipping Task Force appear to have discouraged wrongdoing.

Do we have an anti-flipping task force?There's plenty for this scam. Callahan documents it: http://www.callahansclevelanddiary.com/?p=767

-

-

this is how you "go invest wisely"

GO INVEST WISELY, LLC - Instructions & Processes

Here is the step by step process we have put together.

Each client must understand the purchasing real estate is not a science, although we have broken down what you should except through-out this process.

Review and sign the “BULK FORECLOSURE PURCHASING AGREEMENT”.

Fax, email, mail the agreement to Go Invest Wisely Fax #:801-217-0285 After Go Invest Wisely and Management Company accept agreements, wiring instruction will be sent to your email listed on the agreement.

Go Invest Wisely will issue you ownership of a property with a clean, clear and marketable title. You will work with the contracted client services company to do the following:

GO INVEST WISELY, LLC

2637 North Washington Blvd., Suite 131

Ogden, Utah 84414

877-891-8309

"We offer the reliable and accurate real estate education and training found on the web. We're confident you'll find anything and everything you want to know about real estate investing.

Through strong relationships and resources, we've put together the most lucrative real estate investment opportunities through the Elite Investor Club.

Come back often to remain up-to-date on innovative ways of making money in real estate and to participate in the various money making deals offered in the Elite Investor Club."

In other words, we'll help you get rich or get snookered off someone else's misery. Do they show you the families in the various shelters - the ones who lost their homes? They can be seen here: Mortgage Meltdown - Bill Moyers Journal

Theres a warm fuzzy for ya. Maybe investing in wind or solar is a better idea... at least you could sleep at night - or shall I say, I could.

Post some picture Eagle Eye - maybe we can tell you if the houses are still there before you buy.

FIC/Go Invest Wisely

The so-called Freedom Investment Club in Canada is at:

http://www.ficinvestors.com/

The Chairman and CEO is Mike Lathigee:

http://www.mikelathigee.com/

He just sent out a responce to a huge volume of complaints about Go Invest Wisely from club members. Otherwise, he goes on speaking tours for public seminars. GIW is listed as having only 2 employees but are advertising for more accountants to handle paperwork.

http://www.manta.com/coms2/dnbcompany_hbmyt

The contract agreement:

http://www.goinvestwisely.com/inventory/bulk_purchase/bpcontract.pdf

Club members are advised over the internet and are isolated from each other as from original homeowners facing eviction. Some states are trying to pass legislation protecting homes from foreclosure. Otherwise, there is a pattern of developers buying up whole blocks to put up townhouses and selling the idea to cities as increasing urban density and tax income. Look for rezoning signs announcing multi-family low density.

I don't know of any properties offered in the Cleveland area...what they have listed have been in Missouri. Properties and values can be checked at:

http://www.zillow.com/

134 properties

I counted 134 properties owned by Go Invest Wisely...I am sure that there are more. Lots of properties mysteriously drop off the auditor's database.

go invest wisely in Cuyahoga County

I searched "go invest wisely" at the County Auditor's website and indeed there are 12 pages of homes owned by GIW here.

Here's what Cleveland looks like FYI: Cleveland's Dying Neighborhoods from MaryBeth Matthews StreetSmarts

I'd say you have to be here to make these investments count. We need folks to come here and rehab homes. Cleveland is New Orleans. And corruption (the city and county is rife with it) begets corruption. So if there is a place to get away with murder, Cleveland is the place.

rehab

Go Invest Wisely has just sent out a newsletter. They will be combining staff and operations with Real Property Management:

www.realpropertyutah.com

GIW says this will expand staff, and improve marketing and advertising locally. Local crews will be hired for field services. Over 550 properties needed field services to be redone or completed. From the Rehab Dept.:

"We have been able to place an occupant in the property or close by the property to asure that the rehab work is completed and the occupant is able to move in with no vandalism."

This still does not address the issue of why banks should dump customers, foreclose in mass, and abandon properties in the first place. Plywood is not cheap any more.

Intense wealth consolidation and enslavement of the poor

The people at the top of banking - the Federal Reserve bankers and their friends around the world, don't want lots of banks, they want very few banks - and they don't want people paying a little interest at a low rate on a little debt but huge amounts of interest at a high rate on huge amounts of debt - and they used corrupt politicians to make certain debt stays with people as long and as harshly as possible (e.g. connect employment to credit) - that is why they gave credit to people not credit worthy and made the loans so evil - they have just added another form of enslavement impoverished classes, like the third strike made lifetime prisoners of the poor in the last decade - this decade they imprisoned the poor with debt.

Lots of people will make lots of money in the aftermath... hard to feel good about any of it.

So far economic reforms planned do nothing to solve the problems and do much to enslave citizens further - we'll see how smart and good Obama is as he works through the core problem in America, which is rampant evil greed by just about everyone... thanks media!

Disrupt IT

Go Invest Wisely and FIC (Freedom Investment Club)

Hello EagleSharpEye,

I came across these entries while searching for more information on GIW and FIC, and noticed that some of your posts mentioned that GIW isolates investors, as does FIC, and so individual investors who have invested in these properties through FIC/GIW don't necessarily know one another (which is true).

However, I am based out of the Bay Area (Northern California) and have made the same investments that you probably have, and am looking to connect with other investors who have recently made investments with GIW (via Mohawk Diversified) and FIC, and who are also having issues with getting any reasonable responses from either FIC or GIW.

I invested in August 2008, after an FIC event, where Mohawk was heavily pushed. FIC's Mike Lathigee was there in person as was Alan (a founder of Mohawk Diversified), and the impression given was that this was a service to FIC members.

However, now over 10-11 months later, I find there is no news on the properties being bought, and no definite statements from GIW (who are only stringing things along, and, as near as I can tell, offering up pious platitudes, all the while advertising to investors to invest in "paying properties" for $20K. The properties people earlier bought, are now available for between 10-12K from GIW.

Yet, they have not been able to service those of us, like me, and I suspect many others, from almost a year ago, and have no information available as to when this process will complete, if ever.

So, I am interested in hooking up with other investors who have experienced similar problems, both with the Freedom Investment Club (FIC), who I have also been in touch with (and received some real doozies from!) and GIW.

I can be reached at v [dot] sharma [at] ieee [dot] org or at 408-394-6321, and look forward to connecting up with you, and others and discussing what can be done about the situation.

PS: BTW, I know of at least 3 others people personally, all of whom invested in August'08, and none of whom have any real info. on their "properties" and of course are very far from having a real "owner" for their "property."

PPS: If anyone is out there, who has had a positive experience with Freedom Investment Club and Go Invest Wisely, please, I'd love to hear from you as well.

Global purpose of Realneo

The post by vsharma87 above - concerning the Freedom Investment Club - is one of the primary reasons I put time into Realneo.

Realneo provides a framework - a skeleton - on which anyone who has access to the internet can build upon.

If you have a feeling, if you have an idea, if you have a pain, describe that feeling, idea, or pain on the internet. Then the web can respond.

Everyone in Realneo is a global instigator.

Express yourself.

Liberate someone you've never met.

That's the nuts and bolts of

That's the nuts and bolts of the whole profit making developers dropping into communities like Tremont and throwing out these "programs" for homeowners to obtain fix-em-up-loans, is to make the deals sound so sweet and since the poor people are in need of the cash to do the repairs, they buy into these deals, put their property on the line, and then later times get harder or something else goes wrong and then they're in a worse situation than before. I know this for sure because it happened to my mother. She started out borrowing money to fix up a bathroom and it just grew worse from there - now she's in debt and the old house still needs more work.

Not to mention that when the demolition and rehab started on the Old Gospel Press, all the pounding and vibrations from the constructions has caused her basement to come lose around the top of the ground and now we're having a leakage problem - The company who came out and estimated the damages said it was from the ground trauma and now, we have major problems. Who's going to pay for that?

And for those non-bankable folks, they're just S.O.L. They either feed the family, pay the heat bills, keep the lights on, or try to fix things enough so the housing gustapo will stay off their backs.

-

-

RealNEO Recommends

Thanks dbra--I have taken the liberty of adding this to REALNEO recommends under your list (thanks for giving it a try).

http://www.worldcat.org/oclc/54025774

Cleveland Public Library and Cuyahoga County Library both carry this title available for check-out. I just ordered it for myself:) Also, CPL branches and Main Library pay for the license that allow us to show movies to the public free of charge. This might be a good candidate for a film showing. Brooklyn Branch has a large drop down screen and we have use of a LCD projector to use with a laptop for that wide screen experience.

Who can bring popcorn ???:)

Go Invest Wisely/Mohawk Diversified, Freedom Investment Club FIC

Hello Folks,

Just an update that a number of people contacted me after looking at my previous post. And, thank you for that.

At this time, there is a list of over 87 people, a large number of whom have been dealing with Mohawk Diversified, Go Invest Wisely and FIC (Freedom Investment Club). (The list was independently created, but several who contacted me became part of the list.)

Some have also been dealing with Peak Potentials Training (who also introduced Mohawk and the foreclosure opportunity) to a number of attendees of their events.

Would just like to inform you that there is a Google Group on the subject, reachable here

http://groups.google.com/group/mohawkreosamurais?lnk=srg

where a number of people are having discussions on these organizations, and where useful information related to them exists for anyone who is interested.

Some more investigations may be found here:

http://www.facebook.com/home.php#/profile.php?id=552736084&ref=name

(Please go to "Profile" and scroll about half a page down. Please see all of the 4 comments on the thread for FIC/GIW to get complete information.)

I encourage you to join the Google group, and/or contact me at the information below, as I'd like to partner up with others in similar shoes.

Also, if you are a person who has had a positive experience with this whole group, I wouuld very much like to hear from you as well, and talk to you to see what your experience was.

Many thanks,

-Vishal

****************************************************************

Vishal Sharma, Ph.D.

Metanoia, Inc. (Critical Systems Thinking)

888 Villa Street, Suite 500, Mountain View, CA 94041-1259

Phone: +1 650 641-0082 Fax: +1 650 641-0086 Cell: +1 408 394-6321

Email: v [dot] sharma [at] ieee [dot] org. http://www.metanoia-inc.com

Linked In: http://www.linkedin.com/in/vishalsharma

****************************************************************

Truth About GIW...

GIW is SCUM!

go invest wisely is a scam i

go invest wisely is a scam i unfortunatley bought a house for them and its currently being foreclosed on cause of 4 years unpaid property taxes. my lawyers have been trying to get the deed from them so i can try to save my home. they wont give it up i cant get any help cause theyre "land contract" is not real. i have a 3 year old son and an unborn child due in 2 months thats going to be homeless because of these jerks. my advice is turn them in when u see there postings theyre not a real company and theyre somehow using the last person registered on the houses name so it dont come back on them. theyre frauds and they keep collecting your money and youll always end up loosing the home anyway. its depressing. and sad theyre heartless and have no sympathy for the families theyre hurting

Go Invest Un Wisely

Hello monkeygal, In what town/state is the property you are tangled with located? There may be legal or other activities in your area which may be able to help and may be able to find you here if your location is known.

While Goldman Sachs, Citi, AIG, etc all get public $ to keep them afloat (after they caused the problems), the homeowner in the US is hung out to dry 3 years on...

Sorry about your situation. Chin up. Best Jeffb

Safeguard relocates to Mentor Lake County

REALIZE Lake County...you leave your home and they will take it...

http://www.cleveland.com/mentor/index.ssf/2011/09/post_1.html#comments

Lake County watch your back...

http://news-herald.com/articles/2011/09/27/news/doc4e80d9536a4d2602460570.txt