Submitted by Norm Roulet on Tue, 03/15/2011 - 11:25.

The U.S. Bureau of Labor Statistics just released its U.S. IMPORT AND EXPORT PRICE INDEXES – FEBRUARY 2011 - reporting ongoing significant price increase trends in core sectors of the global economy - like US import and export food and energy prices - that indicate US annual inflation in the double-digits for many products and services impacting daily life in America... like the price of gasoline, milk and bread. The impacts worldwide - especially in developing countries - will be staggering... radicalizing.

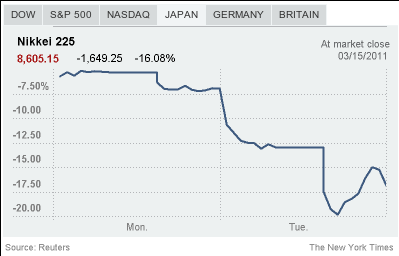

All that real bad economic news, before impacts of growing environmental, human, political, social and economic disasters melting-down life and confidence in Japan and Asia, the Middle East, Africa and North America - from the real impacts of $100+/barrel oil and revolutions in the Middle East... to nuclear disaster in Japan contaminating all life on Earth - have remotely begun to sink in... beyond tanking all world financial markets on this very Black Tuesday, as already reported in the New York Times by 10 AM today:

Japan’s earthquake, tsunami and the nuclear accident are “a negative shock to the world economy,” Mr. Chandler said. Analysts said the potential disruption to global economic supply lines in Japan, home to some of the world’s biggest manufacturing and technology companies, could ripple through the economies of other countries, including the United States, and increase the risk of a global slowdown.

“Japan’s economic prospects, as the world’s third-largest national economy and fourth-most important international trader, affects us all,” Mr. Weinberg said.

On the brightest side one may find, in this news... the NY Times does point out: Oil down more than 3 percent. “People are asking what kind of disruption this means for the global economy. Some think it is going to mean less demand for oil.”

That is fortunate, as the US BLS reports "Fuel prices rose 18.6 percent over the past 12 months, led by a 20.6 percent jump in petroleum prices".

Oil down 3% - big deal.

Add all the real market fear and bad economic reality to real rising import and export price news, from the US BLS, to begin seeing the big picture forming ahead, which appears to come stright from the mind of Bosch.

Some Hellish highlights:

Fuel Imports: Fuel prices increased 4.0 percent in February following a 3.5 percent advance the previous month. Rising prices for both petroleum and natural gas factored into the February increase, advancing 3.7 percent and 12.1 percent, respectively. Fuel prices rose 18.6 percent over the past 12 months, led by a 20.6 percent jump in petroleum prices.

The price index for nonfuel imports increased 3.6 percent the past year, the largest 12-month advance since a 4.8 percent increase between October 2007 and October 2008. The current 12-month rise was mostly driven by a 12.9 percent advance for nonfuel industrial supplies and materials prices and a 15.8 percent increase for foods, feeds, and beverages prices.

Foods, feeds, and beverages prices rose 0.8 percent in February following a 2.5 percent increase the previous month. In February, rising prices for meat, food oils, fruit, and coffee, up 7.2 percent, 5.6 percent, 2.9 percent, and 3.9 percent, respectively, more than offset a 6.4 percent drop in vegetable prices and a 3.9 percent decline in the price index for bakery and confectionery products.

All Exports: Export prices rose 1.2 percent in January following a 1.3 percent advance the previous month. The index has risen at least 0.6 percent every month since a 0.2 percent decline in July 2010. The price index for overall exports increased 8.6 percent over the past year, the largest 12-month advance since a 10.2 percent rise for the year ended in July 2008.

Agricultural Exports: Agricultural exports advanced 4.4 percent in February and 33.5 percent over the past 12 months. The price index for agricultural exports is at the highest level since the index was first published. in March 1985, and the year-over-year increase in February was the largest since a 39.7 percent surge for the July 2007-08 period. Rising cotton prices, up 15.7 percent in February and 153.5 percent over the past year, had the largest contribution to both the February and 12-month advances for agricultural prices. Prices for corn, wheat, and soybeans, which rose 7.9 percent, 11.0 percent, and 3.4 percent, respectively, in February, also continued an upward trend.

U.S. Bureau of Labor Statistics U.S. IMPORT AND EXPORT PRICE INDEXES – FEBRUARY 2011 - USDL-11-0348 (Download .PDF with data tables here - 204Kb)

Transmission of material in this release is embargoed until 8:30 a.m. (EDT) Tuesday, March 15, 2011

U.S. IMPORT AND EXPORT PRICE INDEXES – FEBRUARY 2011

U.S. import prices rose 1.4 percent in February, the U.S. Bureau of Labor Statistics reported today, following a similar 1.3 percent advance in January. The price index for U.S. exports increased 1.2 percent in February after rising 1.3 percent the previous month. Higher agricultural and nonagricultural export prices each contributed to the overall advance in February.

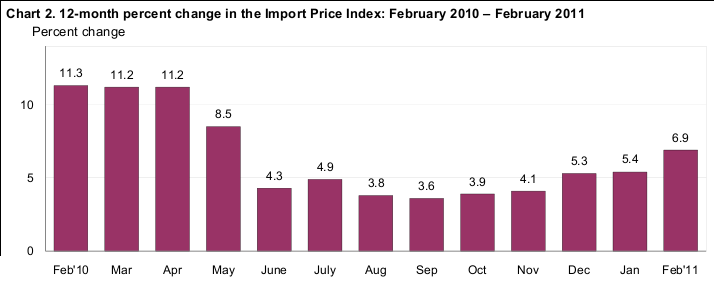

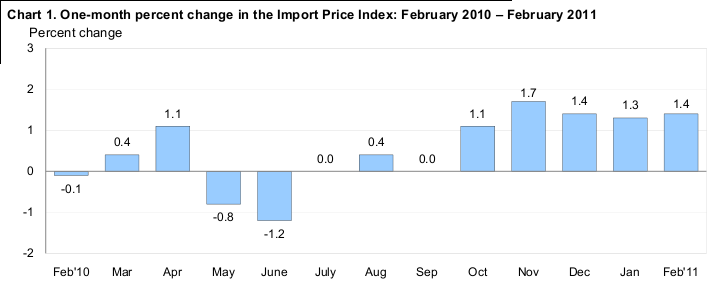

Chart 1. One-month percent change in the Import Price Index: February 2010 – February 2011

Percent change

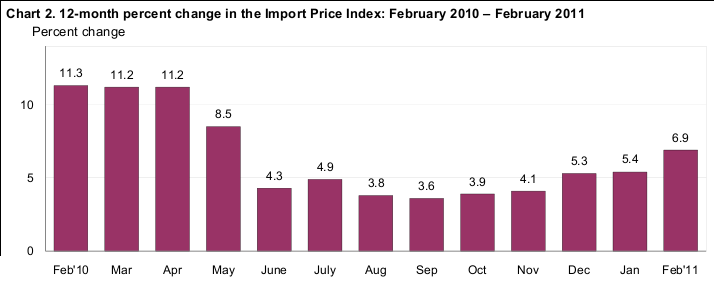

Chart 2. 12-month percent change in the Import Price Index: February 2010 – February 2011

Percent change

All Imports: Prices for imports rose 1.4 percent in February, continuing a five-month trend of monthly

increases greater than 1.0 percent. Import prices advanced 6.9 percent for the year ended in February, driven

by a 7.0 percent jump for the index over the past five months. The year-over-year rise in February was the

largest 12-month advance since an 8.5 percent increase for the year ended in May 2010. Higher prices for

both fuel and nonfuel import prices contributed to the increase in February and over the past year.

Fuel Imports: Fuel prices increased 4.0 percent in February following a 3.5 percent advance the previous

month. Rising prices for both petroleum and natural gas factored into the February increase, advancing 3.7

percent and 12.1 percent, respectively. Fuel prices rose 18.6 percent over the past 12 months, led by a 20.6

percent jump in petroleum prices. Despite rising 23.4 percent over the past two months, however, natural

gas prices declined 10.9 percent between February 2010 and February 2011.

All Imports Excluding Fuel: Nonfuel import prices advanced 0.3 percent in February after a 0.7 percent

increase in January. Higher prices for nonfuel industrial supplies and materials; foods, feeds, and beverages;

and each of the major finished goods categories all contributed to the rise in nonfuel prices in February. The

price index for nonfuel imports increased 3.6 percent the past year, the largest 12-month advance since a 4.8

percent increase between October 2007 and October 2008. The current 12-month rise was mostly driven by

a 12.9 percent advance for nonfuel industrial supplies and materials prices and a 15.8 percent increase for

foods, feeds, and beverages prices.

Table A. Percent changes

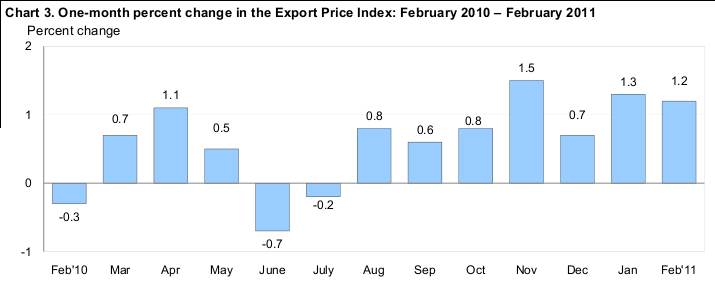

Chart 3. One-month percent change in the Export Price Index: February 2010 – February 2011

Percent change

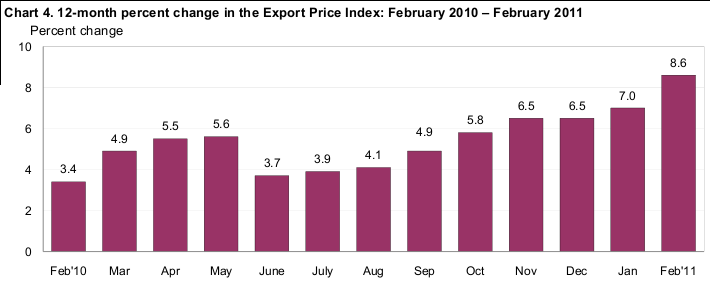

Chart 4. 12-month percent change in the Export Price Index: February 2010 – February 2011

Percent change

All Exports: Export prices rose 1.2 percent in January following a 1.3 percent advance the previous month.

The index has risen at least 0.6 percent every month since a 0.2 percent decline in July 2010. The price

index for overall exports increased 8.6 percent over the past year, the largest 12-month advance since a 10.2

percent rise for the year ended in July 2008.

Agricultural Exports: Agricultural exports advanced 4.4 percent in February and 33.5 percent over the past

12 months. The price index for agricultural exports is at the highest level since the index was first published

in March 1985, and the year-over-year increase in February was the largest since a 39.7 percent surge for

the July 2007-08 period. Rising cotton prices, up 15.7 percent in February and 153.5 percent over the past

year, had the largest contribution to both the February and 12-month advances for agricultural prices. Prices

for corn, wheat, and soybeans, which rose 7.9 percent, 11.0 percent, and 3.4 percent, respectively, in

February, also continued an upward trend.

All Exports Excluding Agriculture: Nonagricultural prices increased 0.9 percent in February following a

1.0 percent advance the previous month. Rising prices in February for nonagricultural industrial supplies

and materials prices and consumer goods, up 2.6 percent and 0.5 percent, respectively, more than offset a

0.3 percent drop in capital goods prices. The price index for nonagricultural exports increased 6.2 percent

for the year ended in February.

Import Prices

Nonfuel Industrial Supplies and Materials: The price index for nonfuel industrial supplies and materials

rose 1.3 percent in February following a 2.1 percent rise the previous month. Higher prices for metals and

chemicals drove the increases in each month. Unfinished metal prices advanced 1.8 percent in February,

while chemical prices rose 1.2 percent.

Finished Goods: Prices for each of the major finished goods categories advanced in February. Consumer

goods prices increased 0.2 percent in February, led by a 0.9 percent increase in the price index for cotton

apparel and household goods. The price index for capital goods also rose 0.2 percent as higher prices for

both computers, peripherals and semiconductors, and capital goods excluding computers contributed to the

advance. Prices for automotive vehicles ticked up 0.1 percent in February after rising 0.3 percent in January.

Foods, Feeds, and Beverages: Foods, feeds, and beverages prices rose 0.8 percent in February following a

2.5 percent increase the previous month. In February, rising prices for meat, food oils, fruit, and coffee, up

7.2 percent, 5.6 percent, 2.9 percent, and 3.9 percent, respectively, more than offset a 6.4 percent drop in

vegetable prices and a 3.9 percent decline in the price index for bakery and confectionery products.

Imports by Locality of Origin: Prices for imports from China continued to rise in January, increasing 0.4

percent for the second consecutive month. Import prices from China have risen 2.0 percent over the past

year, the largest 12-month advance since a 2.8 percent increase for the December 2007-08 period. Prices for

imports from Japan advanced 0.5 percent for the second consecutive month and rose 3.1 percent for the year

ended in February, the largest 12-month increase for the index since a 3.3 percent advance in November

1995.

Transportation Services: Import air passenger fares fell 2.4 percent in February after a similar 2.6 percent

drop the previous month. Lower Asian and European fares contributed to the February decline. Import air

freight prices advanced 1.7 percent in February, following a 1.6 percent decrease in January.

Export Prices

Nonagricultural Industrial Supplies and Materials: Prices for nonagricultural industrial supplies and

materials advanced 2.6 percent in February after a similar 2.5 percent increase the previous month. The rise

was driven by a 3.5 percent advance in fuel prices, a 2.4 percent increase in chemicals prices, and a 15.4

percent jump in steelmaking and ferroalloying material prices.

Finished Goods: Finished goods prices were mixed in February. Capital goods prices fell 0.3 percent,

driven by a 1.5 percent drop in the price index for computers, peripherals, and semiconductors. In contrast,

consumer goods prices rose 0.5 percent in February, while prices for automotive vehicles were unchanged.

Transportation Services: Export air passenger fares fell 6.0 percent in February, the largest monthly

decline since an 8.6 percent drop in September. The February decrease was driven by a 16.8 percent drop in

Asian fares. The price index for export air freight rose 1.5 percent in February and 3.8 percent the previous

month.

Import and Export Price Index data for March 2011 are scheduled for release on Tuesday, April 12,

2011 at 8:30 a.m. (EDT).

tips on pumping gas

[copied from an email]

Here at the Kinder Morgan Pipeline where I work in San Jose , CA we deliver about 4 million gallons in a 24-hour period thru the pipeline.. One day is diesel the next day is jet fuel, and gasoline, regular and premium grades. We have 34-storage tanks here with a total capacity of 16,800,000 gallons.

Only buy or fill up your car or truck in the early morning when the ground temperature is still cold. Remember that all service stations have their storage tanks buried below ground. The colder the ground the more dense the gasoline, when it gets warmer gasoline expands, so buying in the afternoon or in the evening....your gallon is not exactly a gallon. In the petroleum business, the specific gravity and the temperature of the gasoline, diesel and jet fuel, ethanol and other petroleum products plays an important role.

A 1-degree rise in temperature is a big deal for this business. But the service stations do not have temperature compensation at the pumps.

When you're filling up do not squeeze the trigger of the nozzle to a fast mode If you look you will see that the trigger has three (3) stages: low, middle, and high. You should be pumping on low mode, thereby minimizing the vapors that are created while you are pumping. All hoses at the pump have a vapor return. If you are pumping on the fast rate, some of the liquid that goes to your tank becomes vapor. Those vapors are being sucked up and back into the underground storage tank so you're getting less worth for your money.

One of the most important tips is to fill up when your gas tank is HALF FULL. The reason for this is the more gas you have in your tank the less air occupying its empty space. Gasoline evaporates faster than you can imagine. Gasoline storage tanks have an internal floating roof. This roof serves as zero clearance between the gas and the atmosphere, so it minimizes the evaporation. Unlike service stations, here where I work, every truck that we load is temperature compensated so that every gallon is actually the exact amount.

Another reminder, if there is a gasoline truck pumping into the storage tanks when you stop to buy gas, DO NOT fill up; most likely the gasoline is being stirred up as the gas is being delivered, and you might pick up some of the dirt that normally settles on the bottom.

To have an impact, we need to reach literally millions of gas buyers. It's really simple to do.

I'm sending this note to about thirty people. If each of you send it to at least ten more (30 x 10 = 300)...and those 300 send it to at least ten more (300 x 10 = 3,000) and so on, by the time the message reaches the sixth generation of people, we will have reached over THREE MILLION consumers !!!!!!! If those three million get excited and pass this on to ten friends each, then 30 million people will have been contacted!

If It goes one level further, you guessed it..... THREE HUNDRED MILLION PEOPLE!!!

Again, all you have to do is send this to 10 people. How long would it take?

The problem is, America is NOT a Democracy - it is a Republic! As our Founding Fathers established, can we keep it?