SearchUser loginTAX LIEN SALES TO PRIVATE COLLECTION BUSINESSESOffice of CitizenRest in Peace,

Who's new

|

Cuyahoga County Land Bank President Gus Frangos CON ARTIST falsifies documents to obtain a 2nd MortgageSubmitted by Gone Fishin on Mon, 06/17/2013 - 21:02.

Cuyahoga County Con Artist Gus Frangos falsified documents to obtain a 2nd mortgage.

Cuyahoga County Land Bank President, Gus Frangos, falsified mortgage documents with Al Daiide in order to obtain a second mortgage for property located at 6311 St Clair and 1188 East 61st Street in Cleveland, Ohio.

On January 1, 2003, Gus Frangos signed promissory notes to purchase the properties. According to the agreement, Frangos was to pay Dailide mortagage payments in the amount of $300 per month for 6311 St Clair and $250 per month for 1188 East 61st Street.

Al Dailide- the former owner and mortgage holder - was deported from the US in 2004 due to Nazi War charges http://www.standard.co.uk/news/war-criminal-who-handed-jews-over-to-nazis-for-extermination-lives-openly-in-germany-6877906.html

Gus Frangos was well aware of Dailide's unfortunate circumstances and chose to take advantage of the elderly Dailide.

On February 8, 2004, Gus Frangos faxed a letter to Dailide in Germany stating his intent on obtaining a second mortgage on the properties. In order for Gus Frangos to obtain a second mortgage from National City Bank, Frangos requested that Dailid submit false documentation to National City Bank releasing the mortgage liens and submitting satisfactions that the mortagages were "Paid in Full". Frangos told the elderly Dailide that after Frangos obtained the mortgage from National City Bank that Dailide could refile his mortgages on the property.

Frangos specifically stated, " I do not want to volunteer to National City Bank that I am going to place your additional separate mortgages on the properties once the refinances are complete. Therefore, I am using Guardian Title Agency c/o Gayle Jones, 1370 Ontario Street, Suite 300, Cleveland, Ohio 44113 to handle your mortgage filings after National City Bank completes its refinancings and files its first mortgage."

Dailide fell for the con:

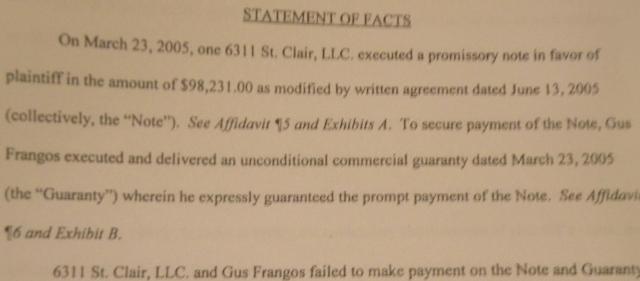

And Gus Frangos obtained the mortgage from National City Bank:

After Dailide signed the mortgage releases, Frangos failed to pay Dailide the promised mortgage:

Which led to this:

Gus Frangos also failed to pay his mortgage to National City Bank, which led to this:

Gus Frangos incorporated 6311 St Clair LLC and named Ladon Ruffin as his agent. On September 15, 2011, Pastor Ladon Ruffin appeared in court, raised his right hand to God, and gave sworn testimony that Gus Frangos hired Ruffin to collect rent for 6311 St Clair and that Ruffin last worked collecting rent for Gus Frangos in March 2011:

Despite years of collecting rent and not paying either mortgage, 6311 St Clair LLC also hasn't paid property taxes in years:

6311 St Clair is currently listed for sale with a selling price of $69,000- considerably lower than the $87,612.31 still owed to National City Bank. According to the real estate records, this property generates approximately $1200 per month in rental income. Despite the rental income collection, no mortgages or property taxes have been paid in years.

http://www.russellrealty.com/p/259/3262329

Gus Frangos FALSIFIED mortgage documents so that he could obtain a second mortgage which has not been repaid. Gus Frangos has committed two counts of MORTGAGE FRAUD.

Mortgage fraud definition:

Mortgage fraud is a crime in which the intent is to materially misrepresent or omit information on a mortgage loan application to obtain a loan or to obtain a larger loan than would have been obtained had the lender or borrower known the truth.

In United States federal courts, mortgage fraud is prosecuted as wire fraud, bank fraud, mail fraud and money laundering, with penalties of up to thirty years imprisonment.[1] As the incidence of mortgage fraud has risen over the past few years,[2] states have also begun to enact their own penalties for mortgage fraud.[3]

Failure to disclose liabilities: Borrowers may conceal obligations, such as mortgage loans on other properties or newly acquired credit card debt, to reduce the amount of monthly debt declared on the loan application. This omission of liabilities artificially lowers the debt-to-income ratio, which is a key underwriting criterion used to determine eligibility for most mortgage loans. It is considered fraud because it allows the borrower to qualify for a loan which otherwise would not have been granted, or to qualify for a bigger loan than what would have been granted had the borrower's true debt been disclosed.

Fraud for profit: A complex scheme involving multiple parties, including mortgage lending professionals, in a financially motivated attempt to defraud the lender of large sums of money. Fraud for profit schemes frequently include a straw borrower whose credit report is used, a dishonest appraiser who intentionally and significantly overstates the value of the subject property, a dishonest settlement agent who might prepare two sets of HUD settlement statements or makes disbursements from loan proceeds which are not disclosed on the settlement statement, and a property owner, all in a coordinated attempt to obtain an inappropriately large loan. The parties involved share the ill-gotten gains and the mortgage eventually goes into default. In other cases, naive "investors" are lured into the scheme with the organizer's promise that the home will be repaired, repairs and/or renovations will be made, tenants will located, rents will be collected, mortgage payments made and profits will be split upon sale of the property, all without the active participation of the straw buyer. Once the loan is closed, the organizer disappears, no repairs are made nor renters found, and the "investor" is liable for paying the mortgage on a property that is not worth what is owed, leaving the "investor" financially ruined. If undetected, a bank may lend hundreds of thousands of dollars against a property that is actually worth far less and in large schemes with multiple transactions, banks may lend millions more than the properties are worth.

Gus Frangos is the PRESIDENT OF THE CUYAHOGA COUNTY LAND BANK and can NOT be trusted. Gus Frangos salary as president of the land bank is dependent upon the collection of delinquent property taxes. Gus Frangos is also an attorney and his conduct is highly unethical. Gus Frangos has a pattern of unethical conduct relative to real estate. READ more on Gus Frangos' numerous scams here http://realneo.us/blogs/lmiller

** My blogs expressing my freedom of speech rights - especially on matters of public concern - are my opinion and not the opinion of my friends, family or employer**

( categories: )

|

Recent commentsPopular contentToday's:All time:Last viewed:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

1188 East 61st Street - Gus Frangos' CON JOB

1188 East 61st Street - a vacant and boarded-up apartment building left to rot- contributing to the foreclosure crisis.

Gus Frangos also was able to obtain the $100,000 open end mortgage from National City Bank on this property:

I searched county records and found NO release that the $100,000 mortgage was ever repaid by Gus Frangos despite selling the property on 6/15/2007 for $169,000.

No property taxes paid for many years. Current tax bill $ 8,952.15

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Guardian Title

REGULAR MEETING • TUESDAY, JULY 24, 2001 • 10:00 A.M.

Jul 24, 2001 – County Engineer, submitting a contract with Solar Testing Laboratories, Inc. in the ... County Recorder, submitting leases with various title agencies for rental of space in the County ... a) Guardian Title & Guaranty Agency.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Examples of MORTGAGE FRAUD

Gus Frangos 2 counts of mortgage fraud are text book examples- written on Gus Frangos' " Attorney at Law" stationery.

Mortgage Fruad:

The FBI defines mortgage fraud as "any material misstatement, misrepresentation or omission relied upon by an underwriter or lender to fund, purchase or insure a loan."

A silent second mortgage, which is unrecorded (or records after closing) and hidden from the lender.

The defendants submitted mortgage loan applications and supporting documents containing false information to lending institutions. The lending institutions relied on these documents to make mortgage loans to the straw buyers to purchase the residential properties. The defendants then prepared and submitted to the lenders, false HUD-1 statements. The defendants created a second version of the HUD-1 statements, listing the actual sales prices, which were provided to the seller. To conceal and perpetuate the fraud, the defendants made some payments to the condominium association and made some mortgage payments to the lenders to prevent foreclosure and continue to receive rental income for the units.

FBI

Mortgage fraud is a part of the FIF subprogram within the FBI’s WCCP. The FBI investigates mortgage fraud in two distinct areas: fraud for profit and fraud for housing. Those who commit mortgage fraud for profit are often industry insiders using their specialized knowledge or authority to commit or facilitate the fraud. Current investigations and widespread reporting indicate a high percentage of mortgage fraud involves collusion by industry insiders, such as bank officers, appraisers, mortgage brokers, attorneys, loan originators, and other professionals engaged in the industry. Fraud for housing typically represents illegal actions conducted solely by the borrower, who is motivated to acquire and maintain ownership of a house under false pretenses such as misrepresented income and asset information on a loan application.

Illegal Property Flipping: Property is purchased, falsely appraised at a higher value, and then quickly sold. What makes property flipping illegal is that the appraisal information is fraudulent. The schemes typically involve one or more of the following: fraudulent appraisals; falsified loan documentation; inflated buyer income; or kickbacks to buyers, investors, property/loan brokers, appraisers, and title company employees.

$$$ more for demo

Money that was to keep folks in their homes will instead be directed to demo contractors...

http://www.chillicothegazette.com/article/20130611/NEWS01/306110019/Officials-not-sold-proposal-demolition-funds

Mortgage Fraud definition

Legal definition of Mortgage Fraud in case Attorney Gus Frangos - PRESIDENT of the Cuyahoga County Land Bank - needs a legal refresher:

Gus Frangos has committed MORTGAGE FRAUD!

Failure to disclose liabilities: Borrowers may conceal obligations, such as mortgage loans on other properties or newly acquired credit card debt, to reduce the amount of monthly debt declared on the loan application. This omission of liabilities artificially lowers the debt-to-income ratio, which is a key underwriting criterion used to determine eligibility for most mortgage loans. It is considered fraud because it allows the borrower to qualify for a loan which otherwise would not have been granted, or to qualify for a bigger loan than what would have been granted had the borrower's true debt been disclosed.

Fraud for profit: A complex scheme involving multiple parties, including mortgage lending professionals, in a financially motivated attempt to defraud the lender of large sums of money. Fraud for profit schemes frequently include a straw borrower whose credit report is used, a dishonest appraiser who intentionally and significantly overstates the value of the subject property, a dishonest settlement agent who might prepare two sets of HUD settlement statements or makes disbursements from loan proceeds which are not disclosed on the settlement statement, and a property owner, all in a coordinated attempt to obtain an inappropriately large loan. The parties involved share the ill-gotten gains and the mortgage eventually goes into default. In other cases, naive "investors" are lured into the scheme with the organizer's promise that the home will be repaired, repairs and/or renovations will be made, tenants will located, rents will be collected, mortgage payments made and profits will be split upon sale of the property, all without the active participation of the straw buyer. Once the loan is closed, the organizer disappears, no repairs are made nor renters found, and the "investor" is liable for paying the mortgage on a property that is not worth what is owed, leaving the "investor" financially ruined. If undetected, a bank may lend hundreds of thousands of dollars against a property that is actually worth far less and in large schemes with multiple transactions, banks may lend millions more than the properties are worth.

http://en.wikipedia.org/wiki/Mortgage_fraud

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

And National City must know what you posted but, despite

losing money, isn't doing anything, letting him get away with it.

It is so tempting to make a citizens arrest:

You can also make a citizen’s arrest if the person admits to the felony or misdemeanor in your presence or if you have undeniable proof he committed the crime. For example, if you engraved your name and identification information on the back of your television and found it in some thug’s apartment, then you’d have grounds for a citizen’s arrest.

Some are trying, but, of course, as things are, it isn't a good thing.

www.infowars.com/lets-march-into-washington-and-place-the-politicians-under-citizens-arrest/

More suspected MORTGAGE FRAUD committed by Gus Frangos

The property located at 1154 East 61st Street and 1158 East 61st Street has nearly the exact same circumstances as above.

Obtaining a new mortgage for more than the value of the property, refiling the first mortgage one day after the second mortgage was granted, collecting rent, not paying property taxes, and not paying the mortgages.

1154 & 1158 East 61st Street have not paid property taxes for years.

One property was recently foreclosed upon for delinquent property taxes and will soon default to the county land bank- back in the control of con artist Gus Frangos.

Gus Frangos - President of the Cuyahoga County Land Bank - whose six figure salary is paid by the collection of delinquent property taxes:

The same GUS FRANGOS that incorporated 1158 East 61 St LLC, the same GUS FRANGOS that signed for the mortgages, the same GUS FRANGOS who hired Ladon Ruffin to collect rent, and the same GUS FRANGOS who I strongly suspect has commited more counts of MORTGAGE FRAUD.

The only difference in this case and the reason I am referring to this as 'suspected ' mortgage fraud is that I do not have written documentation - on attorney letter stationery - to the original owner John Stover requesting that he remove the first mortage. Although I am confident that is what happened.

V-12-773022 TREASURER OF CUYAHOGA COUNTY, OHIO vs. 1158 E. 61ST, LLC, ET AL

NO PROPERTY TAXES PAID IN YEARS . Taxes owed $ 17,220.04

Gus Frangos incorporated 1158 East 61 Street LLC

On January 9, 2003, the deed transfered from John Stover Trust to 1158 East 61st LLC aka GUS FRANGOS - whose Hudson address is visible on the deed

On January 9, 2003 - the same date the deed transferred from Stover to 1158 East 61st Street- an $87,500 mortgage was filed by Republic Bank:

Grantor

Grantee

Grantor

Grantee

References

Con Artist GUS FRANGOS & MORTGAGE FRAUD

1188 East 61st Street:

On March 4, 1999, a mortgage deed was recorded.

On January 9, 2003, Gus FRangos files a quit claim deed transferring the property from Frangos to the self-created LLC 1188 East 61st LLC

On January 9, 2003, Gus Frangos receives a mortgage from Republic Bank for $ 92,400:

Grantor

Grantee

On January 9, 2003 - same date as Republic Bank's mortgage being granted and filed, the original owner Al Dailide refiles his mortage :

Grantor

Grantee

On April 5, 2005, another mortgage is received by National City Bank for $100,000:

Grantor

Grantee

References

On June 15, 2007, the deed transfers to Carl and Michelle Dallas. The liens were not released - mortgages not paid- despite the $169,900 selling price:

Grantee

References

The mortgages received from both banks for this property total $ 192,400 - not counting Dailide's mortgage

The property is vacant and boarded up and was never worth this money in the first place:

Delinquent property taxes owed $8952.15

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

GUS FRANGOS Mortage Fraud

Al Dailide's mortgage deed is originally filed on 12/31/98.

On January 9, 2003, Gus FRangos transferred the property from his name to the self-created LLC- 6311 St Clair

On January 9, 2003, Gus FRangos received the mortgage from Rupublic Bank

On January 9, 2003, Al Dailide's original mortgage is refiled

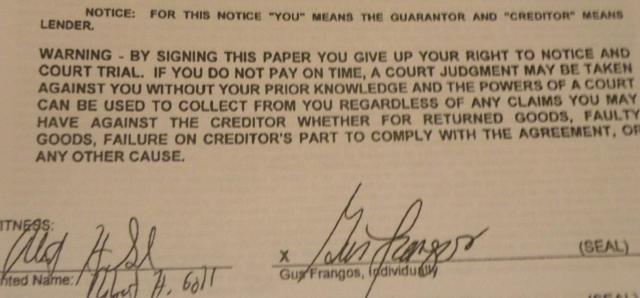

On March 31, 2005, Gus Frangos receives another mortgage from National City Bank.

The mortage from National City Bank was not repaid and led to a civil lawsuit naming Gus FRangos

Gus Frangos - 6311 St Clair

According to county records, Al Dailide allegedly paid Gus Frangos the outstanding mortgage for the property located at 6311 St Clair, and a mortgage release was filed on September 4, 2013.

No mortgage release was found relative to the large mortgage Frangos signed for and obtained.

Gus Frangos has an extensive history of signing for and obtaining large mortgages for his several LLCs, and a history of no mortgage releases in county records relative to the mortgages Frangos' received.

According to Frangos' hired agent's sworn testimony, Frangos owns this property and hired Pastor Ladon Ruffin as his agent to collect and hand over rent money.

The property is still owned by Frangos' shell LLC, 6311 St Clair.

Gus Frangos signed the mortgage documents as, " Gus Frangos, Member 6311 St Clair, LLC."

No property taxes have been paid for years despite years of rent collection. Delinquent property taxes owed $ 7465.91.

No property tax lien was ever sold to predatory tax lien companies.

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*

Who is the 'Incompetent" one??

Cuyahoga County Treasurer Jim Rokakis attacks Budget Director Sandy Turk over cost analysis of land bank

Cuyahoga County Treasurer Jim Rokakis wants the county's budget director fired for producing an analysis that shows Rokakis' land bank initiative could cost county taxpayers millions of dollars.

http://blog.cleveland.com/metro/2009/06/cuyahoga_county_treasurer_jim.html

http://www.cleveland.com/cuyahoga-county/index.ssf/2011/11/cuyahoga_land_bank_gets_new_funding_formula.html

http://www.cleveland.com/cuyahoga-county/index.ssf/2011/07/cuyahoga_county_land_bank_board_breaks_own_bylaws_to_avoid_oversight_county_exec_says.html

* My blogs expressing my Freedom of Speech Rights, especially on matters of public concern, are my opinion and not the opinion of my friends, family or employer*