Submitted by lmcshane on Sat, 01/01/2022 - 12:24.

How do public officials make Land Bank decisions? Artificial Intelligence may seek patterns

by Eye On Ohio Staff, Eye on Ohio

December 27, 2021

Al Jenkins outside of his Cleveland home.

Al Jenkins outside of his Cleveland home.

This project was funded by a grant from the Pulitzer Center and provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism. Please join the free mailing lists for Eye on Ohio as this helps provide more public service reporting.

Al Jenkins has what neighbors called “the nicest house on the block.” The renovated historic structure has fresh gray paint and manicured landscaping. A side lawn looks like it also is his. Jenkins fenced it and cuts the grass. But the City of Cleveland Land Bank won’t sell him the property. He said they told him they are saving it for future development.

Down the street from Jenkins, across from the Cleveland Clinic, bulldozers buzz around new construction on land the city gave to a developer from land bank and purchased property. The new Addis View Apartments will cost about $2,000 for a 2-bedroom in a zip code with a median income of $29,225 according to Census data.

Jenkins is happy about the new development. He’s not just a neighbor but a small-business owner heavily invested in the neighborhood.

“Anything coming to this neighborhood is going to be a plus for us,” Jenkins said.

His block resembles Swiss cheese: historic homes interspersed with vacant land bank lots. Jenkins came from a suburb in 1982. He was tired of spending all his factory income on housing. He eventually bought and fixed up many more rental houses.

So why give properties in the same area to one company and not to Jenkins?

The City of Cleveland did not respond to multiple requests for comment. (Note the city land bank should not be confused with the county land bank, which said it has no such policy.)

Using machine learning methods, Eye on Ohio looked at property remediation in several counties to look deeper at a process that has transformed the rust belt over several years.

Certain factors such as proximity to valuable properties or school district made a property more likely to be picked for remediation in some counties. And in certain areas, officials responsible for economic recovery are the same people in charge of that remediation.

In all six counties analyzed, the amount of taxes owed either didn’t play a practical role, or the model became more accurate by picking parcels with less tax owed, even taking outliers into account. (Though houses in disrepair could have a lower value, and therefore owe less tax.)

In Cuyahoga County, out of all properties behind on taxes in 2018, 2019, and/or 2020, a total of 2,793 went through government foreclosure or ended up in the land bank through gift or foreclosure (counting combined parcels together) through September 2021.

Those land bank properties owed a median 79.0% of lot value, coming in way above the median for all tax delinquent properties, at 3.3%. They owed an average of $22,327, far higher than the $9,774 average for all delinquent properties.

Yet officials didn’t just pick the most decrepit to remediate. Of the top 2,793 properties by amount and percentage of taxes owed, few ended up in the land bank.

Whole categories were excluded, including trailers, even though trailers were one of the top residences behind on property taxes.

In absolute numbers, parcels going to the land bank in African-American neighborhoods far outnumbered those in school districts where most students are white: just 72 properties in majority-white school districts, compared to 2,721 in districts of color.

But keeping the amount owed and the location to high value properties constant, the model predicted a tax-delinquent property in a majority-white district would be chosen over a minority one. Homes in majority-white districts and in the land bank owed less money as a percentage of their lot value (139%) than homes in minority districts (351%.) (Though the median was lower.)

Keeping the amount owed and the school district constant, parcels were more likely to end up in the land bank if they had a greater number of parcels worth $10 million or more within 500 meters (1,640 feet ) of their location.

Al Jenkins’ properties are within 500 meters of the Cleveland Clinic. Patricia White is even closer.

Patricia White just outside her home (right) located near the Cleveland Clinic (back left) and new construction (back right.)

Patricia White just outside her home (right) located near the Cleveland Clinic (back left) and new construction (back right.)

“This sickens me,” said Patricia White, whose house abuts a new development. She said her father lived in the apartment complex formerly on the site, which fell into disrepair in the 1990s. “There isn’t a whole lot of affordable housing.”

All properties given to the land bank or foreclosed upon by the government in Cuyahoga County. Graphic credit: Eye on Ohio, the Ohio Center for Journalism

Looking Back

According to the National Land Bank Network at the Center for Community Progress, there are over 200 land banks nationwide. Eighty-two of those are Ohio county land banks, and several Ohio cities have land banks as well.

Land banks started in Colorado in the 1970s. They were later adopted, particularly in rust belt communities, which kept expanding their reach. In 2009, Ohio passed S.B. 353, allowing a “new breed of county land bank.” In the words of creator Gus Frangos, they became land banks “on steroids.”

“This new class of CIC— a county land bank— not only embraces economic and industrial development, but also community development, which is often necessary to jump start or ‘set the table’ for economic development,” Frangos wrote in a 2018 continuing legal education course on land banks.

Land banks now are vital public agencies. They turn decrepit, often-abandoned properties into viable homes – before they attract pests and crime.

Various studies show they may stabilize housing prices. And very little funding comes from taxpayers. The bulk of their revenue flows from tax-delinquent properties.

“The key problem in a place like Toledo is the changes that happen in industrialization. We just have too many buildings for our community. So in 1970, the city of Toledo had 384,000 as a population. By 2019, that number had dropped to 273,000. So we saw an over 25 percent diminution in the population in 50 years. Now, it’s econ 101 to recognize that if you have housing for nearly 400,000 people but only humans close to 300,000, you have an oversupply in housing and insufficient demand. So the thing that the land banks did, by altering the number of properties within the city, they drove property values back up,” said Shelley Cavalieri, a property law professor at the University of Toledo.

“Distressed properties lower the sale of nearby homes by something like 5 percent. When the land bank takes possession and does some basic mowing and boarding, it reduces that by about a percent. Once a demolition goes through and a vacant lot is owned by a land bank, it reduces that by another 2 percent.”

But land banks have also created tension between officials with more decrepit properties than they could ever remediate versus residents who always consider their neighborhoods a top priority.

That gripe is particularly loud for land bank recipients perceived to have cut in the line.

In 2018, the Cuyahoga County Land Bank gave Coventry Park Apartments on Superior Road to Coventry Park Apartments, LLC, a company owned by Steven Pontikos, Gus Frangos’ nephew. Pontikos later sold it for $1.5 million.

In 2014, the land bank also gave a property to 14078 Superior, LLC, another Pontikos-owned entity. In 2021, the LLC deeded it to Pontikos personally for $0.

East Cleveland gave Pontikos two properties in 2017. He transferred them in 2019 to his solely-owned entities: 14048 Superior, LLC and 1520 Belmar, LLC .

In 2012, the land bank gave a parcel to East Cleveland, which again gifted the land to Pontikos in 2017. Once more, he transferred the parcel to his solely-owned 14042 Superior, LLC in 2019. East Cleveland, Pontikos- and Frangos did not respond to requests to comment.

The Cuyahoga County land bank said they have a detailed conflict-of-interest policy.

“The Cuyahoga Land Bank evaluates available properties on a case-by-case basis to determine whether the acquisition of the property would further the Land Bank’s mission under its agreement and plan with Cuyahoga County. We also take guidance from our community partners such as local government officials, community development corporations, faith-based, and other non-profit corporations that are doing community development work,” said Douglas Sawyer, Assistant General Counsel for the Cuyahoga County Land Reutilization Corp.

“The Coventry Park Apartment properties you are referring to were forfeited to the State of Ohio after they went through tax foreclosure and did not sell at sheriff’s sale. Mr. Pontikos’s company contacted the Land Bank and expressed interest in acquiring the properties through the Land Bank so that his company could renovate the properties and get them back into productive use.”

Land bank staff found Mr. Pontikos well qualified and financially capable of undertaking the large amount of work necessary to get these properties renovated and productive again. Land Bank staff knew Mr. Pontikos was an extended relative of Mr. Frangos and concluded that this fact did not disqualify his otherwise-qualified company from transacting with the land bank.

"In exchange for the company’s promise to renovate the properties, the land bank agreed to acquire the properties from forfeiture and sell them to the company for a total of $50,000. (The county’s website show a sales amount of $0 because transfers out of a county land reutilization corporation are exempt transfers and therefore no sale price is inputted by the county at time of transfer). The properties were successfully renovated and now generate almost $85,000 per year in real estate taxes. Transfers such as this one are exactly what the Land Bank is charged with doing – getting distressed tax foreclosed and forfeited properties back into productive use," he wrote.

Dayton

In Montgomery County, of 34,627 delinquent parcels in 2018, less than 1 percent (281) went to the land bank or were taken by the city in tax foreclosure by late 2021. Two hundred seventy-eight of those properties owed money, with a median $4,049 and an average of $9,395.

Yet of the top 281 worst offenders that year in terms of the amount of taxes owed, just seven were actually foreclosed upon. Those parcels owed an average of $78,207 and a median $53,577. Three years later, 80.9% of them are still delinquent.

Unlike Cuyahoga County though, in Montgomery County, for two parcels owing approximately the same amount, proximity to the most-expensive real estate didn’t matter— and neither did the racial composition of the school district. The net amount of delinquency wasn’t practically significant.

All properties given to the land bank or foreclosed upon by the government in Montgomery County. Graphic credit: Eye on Ohio, the Ohio Center for Journalism

Cincinnati

Hamilton County had the weakest relationship between the amount owed and later entry to a land bank. The median amount owed for land bank properties was lower, $407, than the median for those not going to a land bank, $1,025.

And again, between two parcels owing the same tax debt, those in majority-white school districts were more likely to get picked.

All properties given to the land bank or foreclosed upon by the government in Hamilton County. Graphic credit: Eye on Ohio, the Ohio Center for Journalism

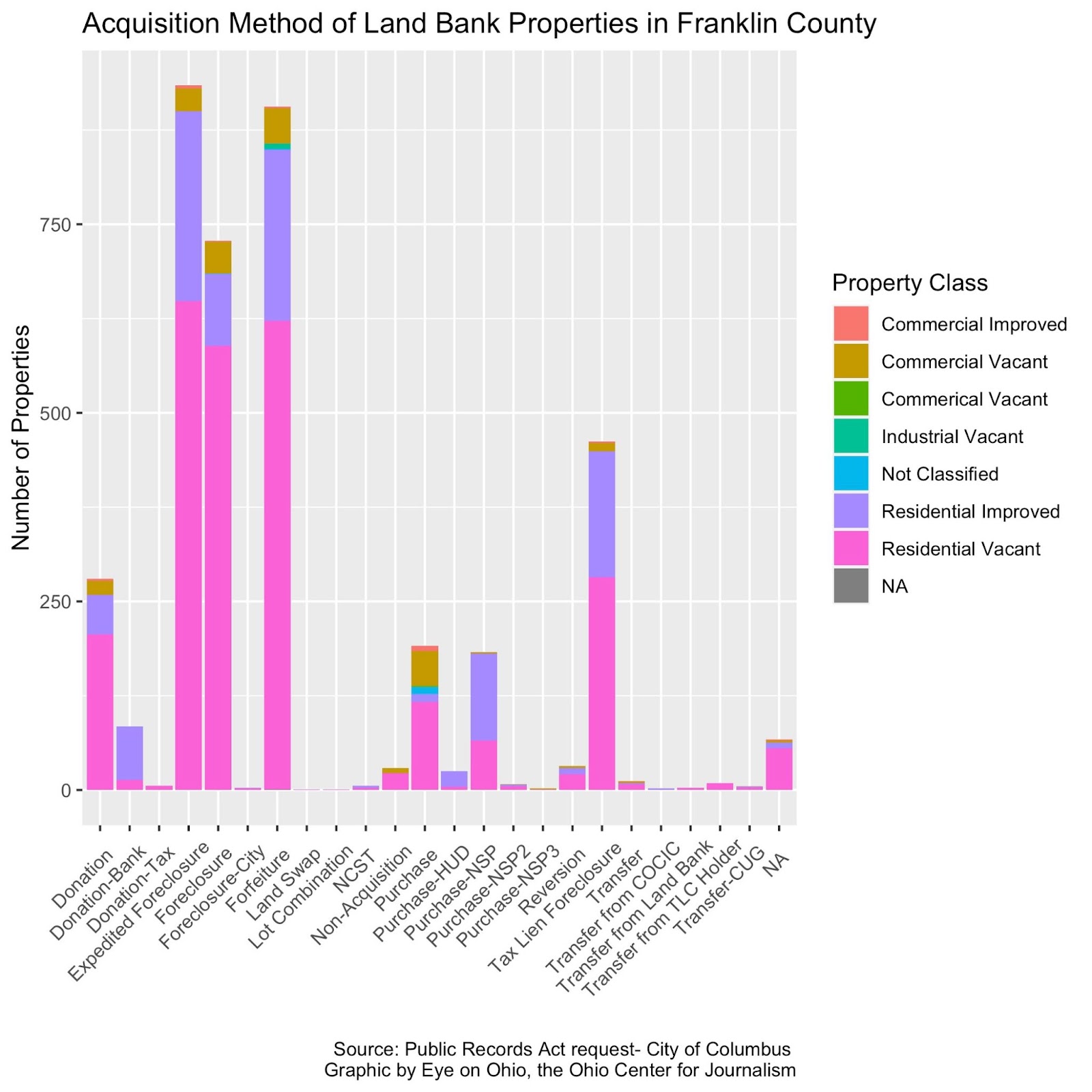

Columbus

Despite Columbus’ population, the Central Ohio Community Improvement Corporation-Franklin County Land Bank has remediated far fewer properties - 3,979 as of publication. But Columbus has had the opposite problem with its housing stock: a growing population and too few houses, particularly affordable ones. According to the U.S. Census, between 1970 and 2020, Cuyahoga County’s population dropped 26.5% from 1.7 million to 1.3 million. Franklin County, in the same time period grew 58.9%, from about 800,000 to 1.3 million.

All properties given to the land bank or foreclosed upon by the government in Franklin County. Graphic credit: Eye on Ohio, the Ohio Center for Journalism

Franklin County saw 70 percent of all Ohio’s population growth in the last decade, according to the latest Census. Columbus’ growth rate in the last decade, 15.1%, surpassed even fast-growing metropolitan areas such as D.C. (14.8%), Nashville (14.7%), Portland (11.8%), Phoenix (11.2%) and Las Vegas (9.9%). In that time, 39% of vacant and abandoned housing disappeared in Franklin County.

Of the 63,685 unique parcels behind on property taxes in the past three years, just 490 went to the land bank, 187 of which still exist to geolocate.

The majority (150) were in minority school districts. But among homes owing the same amount, parcels in majority-white school districts were more likely to go to the land bank. So were parcels within a mile of a parcel worth at least $10 million.

The city has targeted certain areas such as Linden, but that doesn’t mean they can fix the affordable-housing problem, said Michael Wilkos, Senior Vice President of Community Impact at the United Way of Central Ohio, who studies population shifts to see where to send donation dollars.

“Every single structure can be saved if you want to put a lot of money into it. But there are market constraints on that. There was a lot of housing stock in Linden that had been vacant for so long that it had deteriorated to the point where its salvation was unlikely, ” he said.

Wilkos said that unaffordability comes from chronic underbuilding in the Columbus area for the past decade and not enough wage growth to catch up to rising rents.

“Relative to other neighborhoods, the West Side is still a bargain. And there’s still a lot of vacant lots and a lot of vacant houses on the West Side. That’s where an organization like the land bank can really shine. How can we as a community have some vacant lots, constructed with houses, and bring some vacant houses back to life? How can we keep them affordable? So you don’t experience gentrification. So that’s why I can say with a high level of support, Columbus needs a strong land bank.”

Sidebar: What is Artificial Intelligence and why use it to look at public records?

Jim Crowley, Ron Calhoun, Sara Stoudt, and Rich Weiss contributed to this project.

This article first appeared on Eye on Ohio and is republished here under a Creative Commons license.

REALNEO story covered since 2008 now covered by Columbus

A scooped-up side lot and the riverfront parcel that mysteriously got away:

How rules written for distressed ‘Rust Belt’ property may benefit a select few

by Eye On Ohio Staff, Eye on Ohio

November 25, 2022

This project provided by Eye on Ohio, the nonprofit, nonpartisan Ohio Center for Journalism. Please join Eye on Ohio's free mailing list as this helps provide more public service reporting to your community.

On May 12, 2021, Chris and Angela Powers submitted a $4,000 bid for a Lawrence County Land Bank property.

It was above the Auditor’s appraised value of $3,340. But the Powers really loved the riverfront site. The owner of an adjoining property had let them camp right next to it for years.

So they bid for the wooded parcel, on the northern bank of the Ohio River, as well as an adjoining parcel - not on the river, but just behind it.

The Powers attended a May 18, 2021 land bank meeting. The agenda noted that another bid for the riverfront property had been submitted by Ed Gillespie, who owns more than 30 nearby properties and has close ties to the Mayor.

One official motioned to accept the Powers’ bid, but then Mayor Sam Cramblit asked the Powers to leave the public meeting. They did. Upon their return, they learned that officials “tabled” their request.

Knowing there was now someone else interested in the property, the Powers submitted another bid for the riverfront property, this time for $11,100. Chris Powers said he got a phone call from Land Bank Administrator Tom Schneider on June 9 who encouraged him to lower his bid.

That oddity struck Powers as fishy. He asked how much Gillespie had bid. Schnieder said the bids were not public. To be on the safe side, Powers raised his bid again and offered $11,150 on July 14. Powers says he called Schnieder the day before a June 17 meeting to make sure everything was in order.

Schnieder later advised Powers that the board had approved giving the parcel to Gillispie for $11,101.50— $48.50 lower than the Powers’ bid, and coincidentally $1.50 higher than the Powers’ supposedly secret bid. Schnider explained in an email that “due to an inadvertent oversight” the board did not have their new bid.

When the Powers complained, Lawrence County said there was nothing they could do. They also had a new policy. All bids would be submitted by phone, not email. The Land Bank conveyed the property to Ed Gilliespie and his wife in September 2021.

The Land Bank sent the Powers a notice stating that they should come to the January 2022 Land Bank meeting where they would consider the non-riverfront property. The mailed letter, dated December 23, 2021, asked them to come to a meeting on Jan. 5, 2022.The postmark on the envelope is Jan. 12.

Land Bank Properties in Lawrence County as of January 2021.

On its website, the organization’s mission statement reads, “The Lawrence County Land Reutilization Corporation (The “Land Bank”) revitalizes and strengthens Lawrence County Communities and its rural areas by preserving the current property values through the strategic demolition of abandoned, blighted and tax delinquent properties. Rehabilitating abandoned properties of potentially significant value but that are otherwise none [sic] productive due to abandonment and returns or recirculates these properties into productive use through a transparent, public and community oriented process.”

A year-long investigation by Eye on Ohio paints a different picture. By combing through hundreds of property and tax records, most not online, and combining results with machine learning methods, reporters found that a combination of the property’s size, taxes owed, how long the property had been abandoned, and its distance to the river could predict remediated properties 89% of the time.

A lesser distance to the river was among the most important contributors to the model, not counting properties certified delinquent in the past two years (when covid temporarily altered the foreclosure process). Being closer to the river and owing less money actually made properties more likely to enter the land bank. For example, a tax-delinquent property within 0.27 miles of the Ohio River had a 24% chance of remediation in the prediction versus properties further away, which only had a 9 percent chance.

A look inside the computer model to predict Land Bank remediation.

Note: This does not include properties delinquent from 2020 on, when Covid temporarily altered the foreclosure process. (Graphic Credit: Eye on Ohio.)

In hard-hit Lawrence County, there is no shortage of blighted properties. But some land-bank parcels did not need rehabilitation - such as the undeveloped riverfront lot the Powers tried to buy.

Lawrence County has approximately 5,000 properties on its certified delinquent list. Almost 400 properties have gone through the land bank.

About two-thirds of delinquent properties were in arrears for less than $1,000. Most properties are not behind for more than a couple years. Among those owing more, however, property owners failed to pay taxes for 9.6 years, on average. One property had not paid since 1981.

And remediated properties were not among the most egregious debtors. Nearly 90% of land bank properties owed less than $5,000.

Local officials provided responses to public records act requests, such as the county’s acquisition policy, but did not respond to several follow up questions. The Gillespies declined to comment by phone. An email they used to request the property is no longer in service.

Ohio passed special legislation for county land banks in 2006, and the mortgage crisis of 2008 made many Ohio counties enthusiastic adopters of the model. Fast-track foreclosure policies have been key to stabilizing housing prices in some areas but critics argue it gives county officials too much leeway in deciding who gets rehabilitated when there will never be enough funding to remediate every decrepit property in the Rust Belt.

Last year, Eye on Ohio published its first look at Land Banks using machine-learning methods. Certain factors such as a parcel’s proximity to valuable properties or its school district made it more likely to be picked for remediation in six counties. In some places, officials responsible for economic recovery also are in charge of property remediation.

Al Jenkins, standing in the side lot he cannot buy, showing a picture from his Land Bank application.

His house is in the background. (Photo credit: Eye on Ohio)

When Al Jenkins moved north from Georgia, he remembers the date well: it was November 22, 1963, the day President John F. Kennedy was shot. The country was in an uproar, and he was panicking as well, fleeing escalating race violence that then gripped the South.

He remembered with a twinge of regret a friend who owned a gas station. When Jenkins visited home 2 years later, the friend asked him to come back.

“They found his body in that station,” Jenkins said, his voice low.

Upon arrival in Cleveland, Jenkins spent a year as a janitor at a hospital then found full-time work at a factory. He bought his first property downtown in 1985 and fixed it up. He eventually invested in several more properties in the area and rented them out. In Cleveland, Jenkins could control his own destiny. Or at least he could until recently.

The one property Jenkins does not own is the side lot next to his house that he cleaned up, landscaped, and fenced. Even a year after the initial story surfaced, the city still will not sell him that side lot.

According to a city official: “We do sell side yards and we have a fairly robust program. That said, there are areas in the city where we aggregate land for future development. The Upper Chester area (between Chester and Hough) is one such area where there has been a lot of recent interest. This is the reason Mr. Jenkins’ request was denied in April 2020 – because this side yard is in a location proposed for redevelopment, specifically in-fill housing with some interested parties looking to develop low-income housing.”

The city did not answer further questions about the lot, such as who, exactly, is interested in it and why Jenkins cannot be among them. They offered to lease him the property until further development. He declined.

“I think it’s a lost cause,” Jenkins said. “I’m done, I don’t know what to do. I’m baffled by it.”

This project was supported by the Data-Driven Reporting Project.

Read More: Plaintiff, Defendant, and Judge: How some Ohio counties entrust the same officials to collect taxes and wipe tax liens

Sidebar: What is Artificial Intelligence and why use it to look at public records?

Jim Crowley, Ron Calhoun, Sara Stoudt, and Rich Weiss contributed to this project.

This article first appeared on Eye on Ohio and is republished here under a Creative Commons license.

AI to understand corrupt Land Bank

https://eyeonohio.com/how-do-public-officials-make-land-bank-decisions-artificial-intelligence-may-seek-patterns/

Pay close attention to the embedded map. Maple Heights has been targeted for flipping to land bank's preferred developers.